Since an Sdn Bhd company is considered a separate legal entity the owners personal wealth is protected which is one of its major advantages. But with our online GST calculator you can find the GST easily.

These are applicable for native labors who are actively serving various businesses in this country.

. The Financial Reporting Framework in Malaysia very simply works like this registered companies in Malaysia are all required to prepare statutory financial statements. You can use our GST calculator online tool by following these simple and straightforward steps. Advantages of DTAA.

Employment laws in Malaysia provides standard conditions for specific types of employees working in this nation. The Employment Act 1955 Malaysia is the core legislation approved for the welfare and all relevant aspects of employee in Malaysia. Sdn Bhd companies in Malaysia come with business continuity which means the business can carry on until such time when there is a valid reason as to why it needs to cease its business operations.

These depend on various. Additionally Quebec Sales Tax must be paid by Quebec-based firms in addition to Canadas standard Goods and Services Tax GST. Labuan companies enjoy tax advantages with a tax rate of 3 on audited net profits for companies that carry out trading activities and 0 for companies that carry out non-trading activities.

Cultural differences While the US. Melayu Malay 简体中文 Chinese Simplified Malaysia Financial Reporting Standards. This post is also available in.

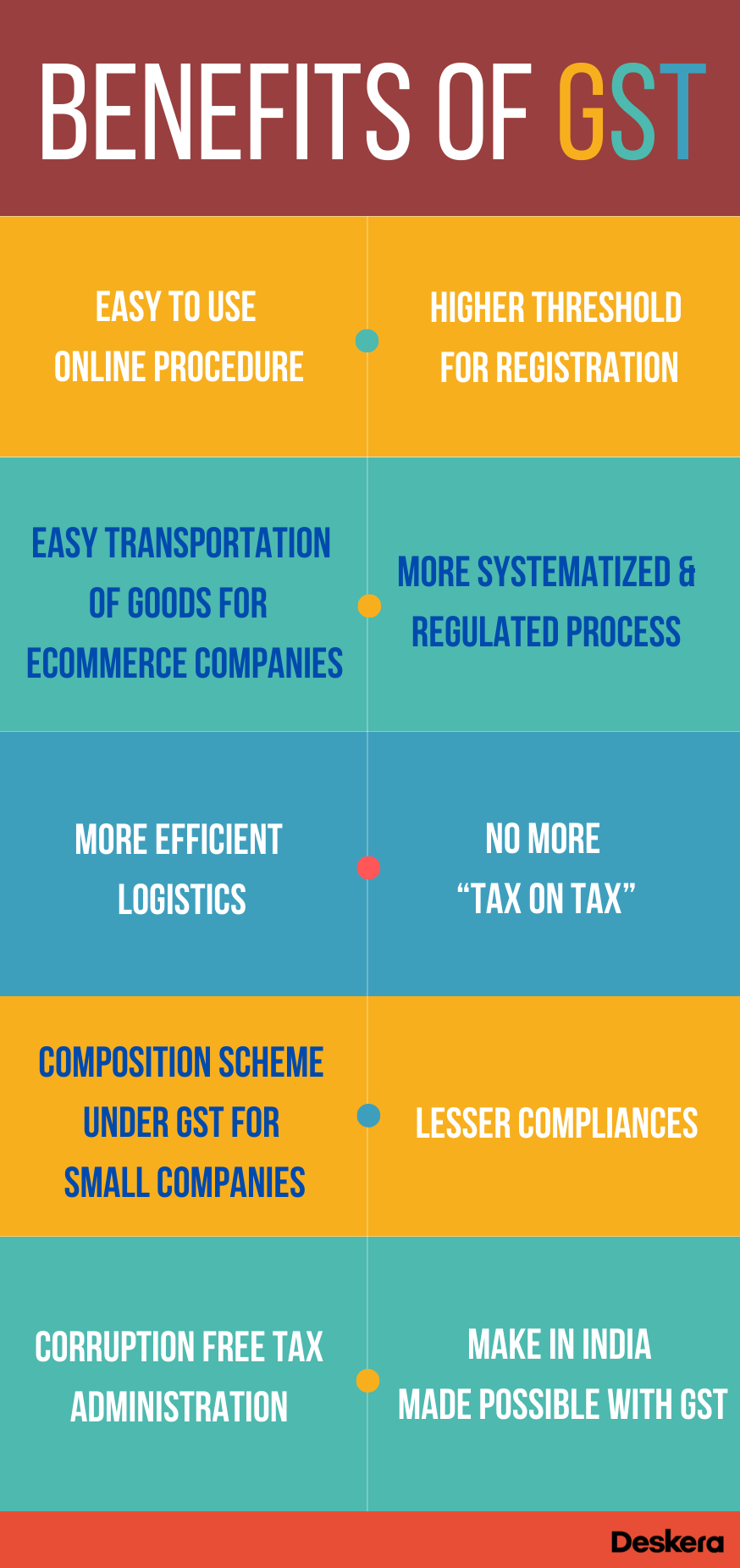

The intent behind a Double Tax Avoidance Agreement is to make a country appear as an attractive investment destination by providing relief on dual taxation. Now there are different types of invoices that are issued under the GST law. This guide provides an overview of the key concepts of Singapores Goods.

General Information on GST Return Late Fees. According to the GST Legislation a late fee is an amount imposed for late filing of GST Returns. Foreigners who have been living in Malaysia for a certain period and by observing the local laws and regulations may apply for permanent residency and citizenship in MalaysiaThe status of permanent resident offers a number of advantages among which the ability to reside in the country for an indefinite period of time without any visa requirements the ability to work and.

If you want to add GST click on the GST Inclusive button or tap on the GST Exclusive button if. Advantages of Green Economy- 1. The GST law makes it necessary for registered taxpayers to issue invoices for the sale of goods or services.

When a GST Registered business fails to file GST Returns by the prescribed due dates a prescribed late fee. Green economy potentially works towards decreasing environmental pollution and thus improves the quality of soil water and air and also protects environmental. Is indeed similar to Canada in many ways companies should remain sensitive to the key differences.

This is because the tax invoice not only enables the seller to collect payments but also avail input tax credit under GST regime. Services Tax GST system as it relates to Singapore companies definition of GST registration requirements advantages and disadvantages of GST registration filing GST returns and schemes to. This relief is provided by exempting income earned in a foreign country from tax in the resident nation or offering credit to the extent taxes have been paid abroad.

A Labuan trading company is a company established in Labuan Malaysia that carries on certain Labuan trading or non-trading activities.

Mercedes Benz Pre Owned Vehicles Ad Delhi Times Check Out More Car Advertisement Collection At Https Www Advertgallery Co Mercedes Benz Benz Car Advertising

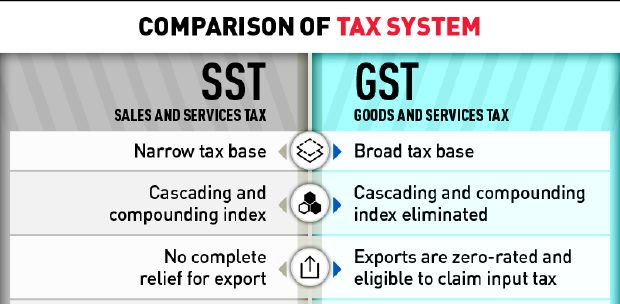

Gst Better Than Sst Say Experts

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Mortgage Interest Tax Software

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Mortgage Interest Tax Software

How Gst Affects Smes From Registration To Daily Operations Benefit Registration

Malaysia Gst Baby Milk Baby Mittens Baby Formula

Upto 5 Lacs Worth Furnishing Or Stamp Duty Registration Free Triveni Laurel Www Triveniinfra In Free Offer Laurel Stamp Duty

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Mortgage Interest Tax Software

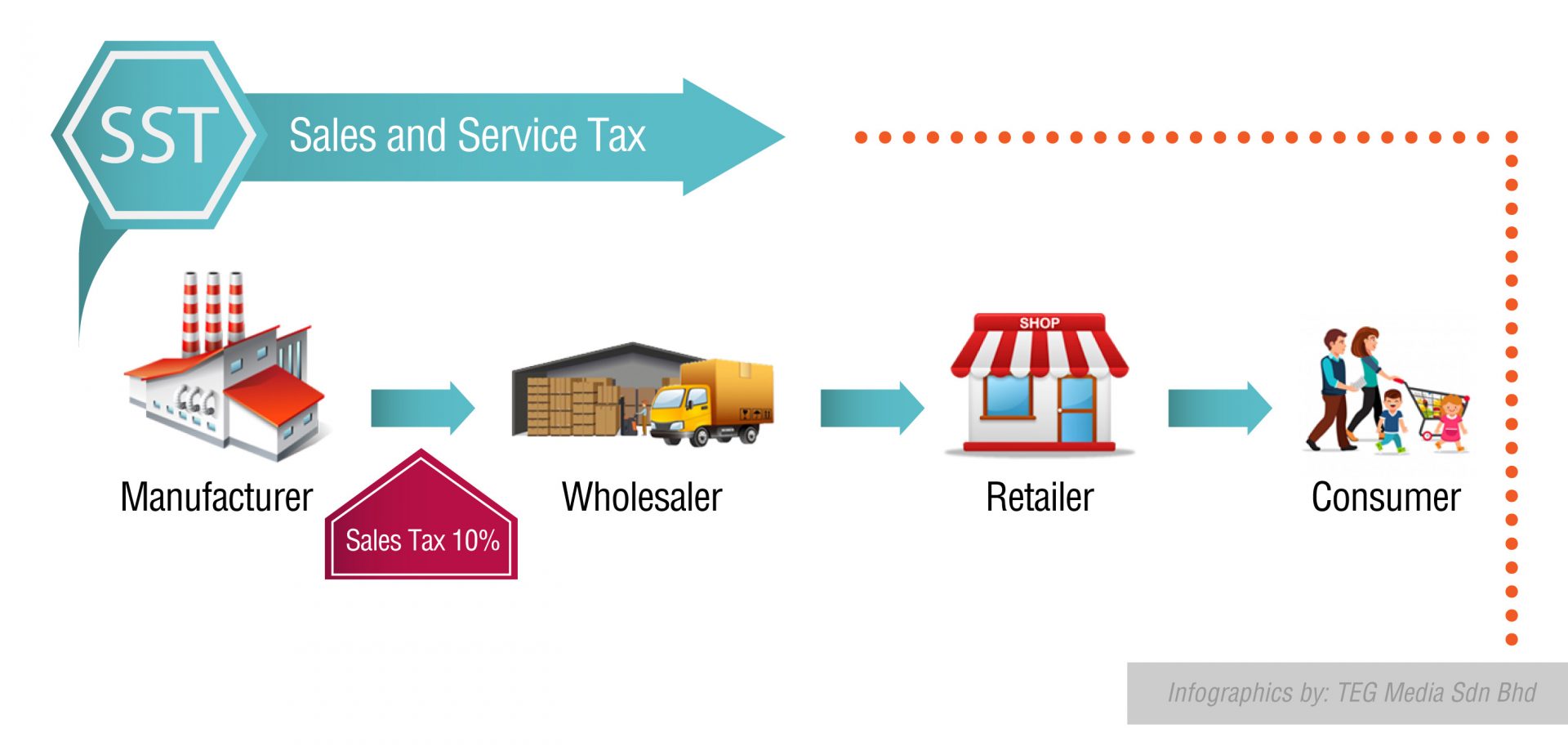

Sst Vs Gst How Do They Work Expatgo

Gst Better Than Sst Say Experts

Check Out Our Ad In Loksatta Presenting Monsoon Magic Offer Limited Period Advantage Pay 0 Gst Book Today Save Upto Rs 3 Ambernath Eco Luxury Real Estate

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Mortgage Interest Tax Software

Sst Vs Gst How Do They Work Expatgo

Economics Class 12 Cbse Project On Gst Goods And Services Tax Economics Goods And Services Goods And Service Tax

Why The Gst Became Malaysia S Public Enemy Number One The Diplomat

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Mortgage Interest Tax Software